The banking industry’s top security concerns come from online threats. In today’s world, organized cybercriminals have become more prevalent than traditional bank robbers. Banks and other financial institutions process millions of monetary transactions on a day-to-day basis, with most of the transactions being done online. Banks and other financial institutions have become the most lucrative targets for cybercriminals. For those cybercriminals looking for monetary gain, attacking a financial institution or bank offers a tempting opportunity for profit through theft, fraud, and extortion.

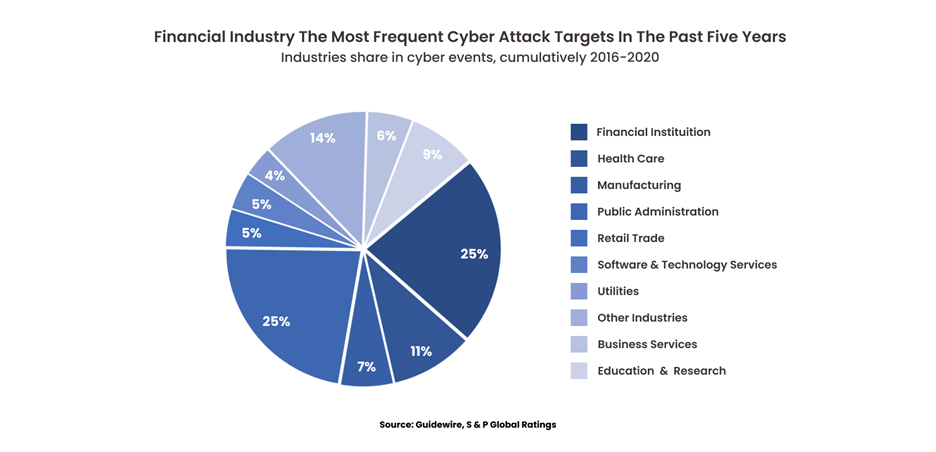

According to the S&P Global report, financial institutions have maintained the top position and experienced overall more than a quarter of the total cybersecurity issues. The financial institutions made up of Banking, Financial Services, and Insurance faced nearly 26% of cybersecurity threats which is nearly 2 and a half times greater than the amount experienced by the Healthcare industry.

Source- S&P Global Ratings

The rapid rise in the volume of cyberattacks further emphasizes the importance of cybersecurity in banking and financial institutions. Cyberattacks can be expensive for any large organization, for small financial institutions and credit unions, they may be unrecoverable.

Reasons why Cyber Security is important in Financial Institutions

Prevent Financial Losses

Imagine finding several large fraudulent charges on your bank statement. Generally, when this happens, an individual’s funds can be recovered by contacting the bank. However, this is not the case when it comes to a data breach.

When a bank, or other financial institution, faces a cyberattack that resulted in the loss of customer funds, the lost funds can be very difficult to recover. Not only does this impact the bank’s public reputation, but it also causes substantial stress to the customer. To minimize damages from data breaches, financial institutions must implement a cybersecurity risk management plan that identifies possible risks and provides effective safeguards and mitigations. This is essential for identifying weaknesses and safeguarding critical infrastructure against cyberattacks to ensure financial protection to their customers.

Protect Customer Data

When a customer’s private information becomes compromised, the rate at which it is distributed can make it near impossible to recover completely. Often when the customer notices the malicious activity, it is too late. Cybercriminals use the stolen information and sell it to other malicious actors furthering the rate that the original account and associated accounts become compromised. As banks expand and gain new customers, they should follow cybersecurity best practices to protect themselves and their customer’s personal information.

Protect The Financial Institution’s Reputation

Consumers prefer to engage in business with organizations that they can trust. This need for trust is even more important when it comes to their finances. After all, no one wants to risk their money in an organization that they cannot rely on.

When a customer has read about a successful cyberattack at their local bank, it can gravely damage the bank’s reputation. After a successful attack has become publicly known, many of the customers are likely to close their accounts and take their business elsewhere. Reputation is everything for a business that wants to survive, especially for a bank. Exercising good cybersecurity practices and developing a cybersecurity risk management plan make customers feel more secure when choosing a financial institution.

Financial Institutions can face fines for lack of Cybersecurity

Banking and financial institutions can face penalties and fines if they fail to comply with industry regulations. When Equifax was attacked, resulting in the data of 147 million Americans potentially compromised, the FTC issued a $700 million penalty. Financial institutions need to prioritize cybersecurity and develop good cybersecurity practices to protect themselves and fit the unique needs faced by the financial institution.

Many rules and regulations were created to govern banking, and banks can face huge penalties for not maintaining the minimum standards. These penalties can result in more than financial loss as they tarnish the bank’s reputation and deter future customers.

Regularly revisiting and updating the cybersecurity risk management plan and developing a cybersecurity-minded atmosphere can aid banks and financial institutions to build a reputation known for security. An investment now in your own cybersecurity solution is a critical step to protect your own business and stay competitive.

Follow us on Facebook, & LinkedIn or Contact us, 406-646-2102 and get your questions answered.